Minimal Movement in Stock Futures Signals Market Caution

As June's first trading day approached, stock futures exhibited barely noticeable changes, reflecting an atmosphere of caution. The Dow Jones Industrial Average futures saw a modest rise of 27 points, marking a 0.1% increase. Comparatively, S&P 500 and Nasdaq 100 futures remained largely stagnant, signaling that investors are treading carefully in this uncertain market climate.

A Notable May: Strong Performance but Slowed Momentum

May was a month of robust performance for the stock market, with all three major indices enjoying their sixth positive month in the past seven months. The Nasdaq Composite stood out with a significant 6.9% increase, its most impressive monthly growth since November 2023. Despite these gains, the market's pace slowed towards the end of May. The Dow Jones, S&P 500, and Nasdaq Composite all closed more than 1% below their respective record highs, indicating a weariness among investors.

Tech Stocks and Market Volatility

Tech stocks, which have often driven market rallies, faced notable setbacks as May drew to a close. Nvidia, a key player in the tech sector, experienced declines, contributing to the Nasdaq Composite's 1.1% dip in the final week of May. This pattern highlights a broader trend where high investor expectations for growth and tech companies lead to severe market reactions when these companies fall short of earnings projections.

Dylan Kremer's Insights on Investor Sentiment

Dylan Kremer, Certuity's chief investment officer, offered insights into the shifting market sentiment. According to Kremer, the current market conditions are heavily influenced by investors' high expectations for growth and tech companies. As a result, companies failing to meet these expectations face significant repercussions, reflecting a market ripe with both opportunities and risks. Kremer also emphasized the delicate position of growth stocks amidst interest rate volatility.

The Impact of Federal Reserve Decisions

One of the key factors contributing to the cautious market sentiment is the anticipated meeting of the Federal Reserve. Investors are keenly aware of how interest rate changes can impact growth stocks, which are particularly sensitive to such fluctuations. The Federal Reserve's decisions will likely play a crucial role in shaping market movements in the coming weeks.

A Busy First Week of June Lies Ahead

The first week of June is anticipated to be a bustling period for the financial markets, with several key economic updates on the horizon. Monday will see the release of significant manufacturing data, providing insights into the health of the manufacturing sector. Additionally, a crucial jobs report is scheduled for Friday, which will offer a clearer picture of employment trends and economic stability.

The Broader Economic Context

These upcoming economic indicators will be instrumental in shaping investor sentiment and market directions. They will offer valuable data points for gauging the economy's current state and future prospects. Investors and analysts alike will be scrutinizing these reports to adjust their strategies and expectations accordingly.

Looking Forward

As investors gear up for June's trading activities, the cautious approach observed in stock futures suggests a market environment marked by both optimism and apprehension. The robust performance of May offers a positive backdrop, yet the slowed momentum and tech stock volatility underscore the market's inherent risks. With critical economic updates and Federal Reserve decisions on the horizon, the financial landscape of June promises to be dynamic and pivotal.

In conclusion, the minimal movement in stock futures ahead of June's first trading day is a clear indicator of the market's cautious stance. Despite recent gains, the road ahead is filled with potential hurdles. Investors will be closely watching the developments in key economic indicators and Federal Reserve decisions, which will undoubtedly influence market trajectories in the coming month.

18 Comments

Write a comment

More Articles

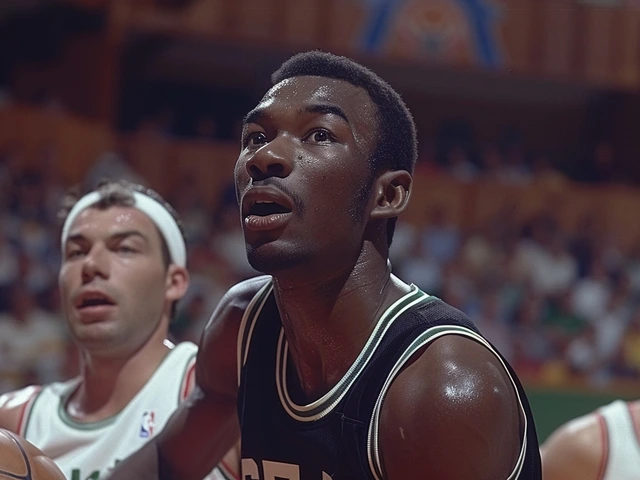

Boston Celtics' Unstoppable Offense Shines Again in NBA Finals Victory Over Mavericks

In a masterclass display of modern NBA offense, the Boston Celtics overpowered the Dallas Mavericks in Game 2 of the NBA Finals. Combining effective 3-point shooting and midrange efficiency, the Celtics demonstrated their strategic prowess, putting them within three games of an 18th NBA title.

76ers Edge Warriors 118-115 as Maxey Blocks Curry, Ends Home Losing Streak

Tyrese Maxey scored 34 points and blocked Stephen Curry's final shot as the Philadelphia 76ers edged the short-handed Golden State Warriors 118-115 at Xfinity Mobile Arena on December 4, 2025, snapping a home losing streak and crushing betting over/under lines.

Timberwolves vs. Mavericks: In-Depth Analysis and Predictions for the Crucial Western Conference Final

The NBA Western Conference Final is set with the Timberwolves and Mavericks clashing for a spot in the NBA Finals. The Timberwolves, having had a stellar run, will challenge the Mavericks, who have shown remarkable strength. With Minnesota's slight edge in offense and stronger defense, they are favored to advance to the Finals.

Ankit Maurya

June 3, 2024 AT 20:42The market's tepid start is a clear reflection of the collective anxiety that has settled over investors, and it should serve as a warning to complacent traders. The minuscule rise in Dow futures barely masks the underlying tension. Our nation’s economic resilience demands that we scrutinise every data point with unwavering focus. I feel the atmosphere is heavy, as if the market is holding its breath waiting for a decisive cue from the Fed. It is essential we do not underestimate the significance of these subtle movements.